The Power of 1%

Today, I want to talk about one of my favorite topics: what happens when you increase unit revenue by just one percent.

What is unit revenue? That’s revenue per capacity unit, like revenue per ton-mile, ton-kilometer, cubic foot, cubic meter, twenty-foot container equivalent, etc.

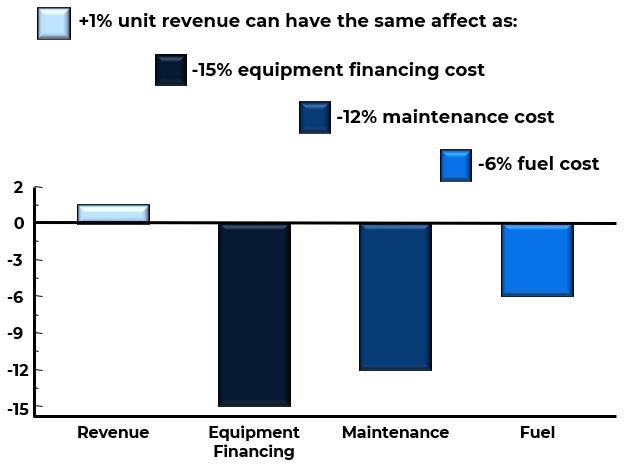

That doesn’t sound like a lot. But if your pre-tax profit margin is just 5%, it means a 20% increase in profitability … a game-changer for most businesses.

That additional profit means money to reinvest, whether in more skilled staff or newer, more fuel-efficient assets – money that you don’t have to borrow.

It’s almost impossible to increase your margins by 20% by slashing costs. You can only cut so deep before you hit muscle or bone. Eventually, every freight or cargo carrier reaches a point where it can no longer safely or effectively cut costs.

You’ve seen the cost-cutting approach tried over and over, especially if you’ve been on the receiving end as a customer. This story never ends well. Reduced staffing, deferred maintenance, selecting cheap handling partners over reliable ones … resulting in unreliable service, angry customers, and disgruntled staff. The ultimate result is a service provider that’s treated by its customers as a commodity, only to be chosen when it underprices its competitors.

An airline executive twenty years ago was famous for telling his employees, “You can make a pizza so cheap, no one will eat it.” And this is true for any service business.

Why do I mention airlines? Because cargo and freight transport business models are quite similar to passenger transport. Here are a few key similarities … see if these ring true for you:

- High fixed costs, especially labor, fuel, and capital

- Low marginal costs; the incremental cost of carrying one extra container, pallet, parcel, suitcase, or passenger is very low

- Often some amount of unsold capacity, although that hasn’t often been true for cargo or freight carriers the past couple of years!)

- Lack of service differentiation: as another airline executive put it, “The way most customers perceive brands is, ‘wow, the seats on today’s flight are blue!’” Can your shippers see any meaningful difference when they ship with you?

- A wide range of shipper willingness to pay

- Differing time sensitivities for different cargoes

How can you achieve a 1% increase? You can start by figuring out where you have more volume than you can carry and increase your rates accordingly. I’m sure that sounds basic, but it’s shocking how many carriers simply throw up their hands and say “it is what it is” rather than adjusting their pricing to manage demand.

Over time, as you learn more about your customers’ future demand and requirements, you can begin to understand demand trends early enough to plan your capacity ahead of them, instead of merely reacting via price or schedule changes.

Also, are you setting your rates by physical weight, volume, pallet quantity, or something else? If you’re charging by one dimension but are constrained on a different one, you need to change your pricing. For instance, charging by physical weight is still shockingly prevalent in air cargo, even though volume is almost always the constrained metric. Note: there are specific situations where you may need to use a different metric, for example when a shipment is very heavy relative to its volume.

Another important step is to differentiate your service levels or create new ones if you only have a single service level today. Every shipper has a different willingness to pay and different needs. A shipper’s willingness to pay is usually directly correlated with time sensitivity of the shipment, so the easiest way to charge more is to offer multiple levels of time-definite delivery.

If you aren’t tracking your on-time performance, now is a great time to start. Especially in today’s chaotic supply chain environment, reliability is highly valuable and will allow you to charge a premium.

Unfortunately, too many carriers still believe shippers won’t pay for speed. Before covid, one air cargo expert suggested carriers should stop speeding up transport times and instead concentrate on differentiating by levels of reliability. He said, “People should be perfectly happy to value, for instance, an 85% reliability within a certain performance window at a specific price level and then accept that a higher reliability at a stricter performance window should be valued at a different price.”

I have several problems with this. First, the idea of “performance windows” versus shipping speed is a distinction without a difference. The “performance window” is a commitment to your shipper or BCO that you’ll deliver their shipment within X days or X hours after it’s tendered. How is that any different from a shipping speed?

Also, setting an 85% reliability standard is the same thing as telling your customer, “We’re going to be late 15% of the time and you’re going to have to live with it.” In a world where Amazon and others make time-definite delivery a core customer expectation, that simply won’t work.

The challenge for carriers is not to speed up delivery per se, but to offer deferred options – call it a “wider performance window” if you like – that allow shippers to pay a lower rate and give you flexibility on when to carry which shipments through your network. Expedited shipments always travel on the first available departure, while slower shipments can be carried when you have space for them, allowing you to balance volume with available capacity.

Occasionally, this may result in delivering a shipment earlier than promised. That’s okay! Think of it as a “surprise and delight” bonus for your shipper. When DHL launched a US deferred ground service in the early 2000s, it didn’t have enough volume to fill trucks to many of its smaller stations. To minimize service cost, they carried the quote-unquote “ground” packages through their air network and delivered them early – or held them in the destination station until the scheduled arrival day if the last-mile van on a particular route was full.

The shipper got the service they paid for, while DHL filled otherwise unused air capacity and won some incremental business without having to operate half-empty trucks. You can take similar steps as you develop faster and/or multi-modal service options for your customers.

The next step is building up a portfolio of optional service features that customers can select (or not) as their needs require. The highest priority should be those features that are easy to implement; the simplest is shipment preparation, i.e. palletization and depalletization. If you don’t have the staff to handle this, find a service provider who can do it for you.

The optimal scenario would be to find a forwarder that’s willing to build pallets and handle paperwork but give the carrier full price visibility (i.e. carrier quotes rates, not the forwarder, and carrier pays forwarder for value-added services.

Here are a few other ideas to expand your service offerings:

- Customs documentation and clearance, also known as customs brokerage

- Insurance

- Priority offload / priority clearance

- First-mile and last-mile transport, also known as cartage or drayage

- Multi-modal partnerships, especially those allowing reroutes around shipping bottlenecks like congested ports

Yes, forwarders can arrange and sell all these for you and your shippers, but when they do, they’re taking away incremental profits that could have gone to YOUR business instead!

An excellent starting point for identifying growth areas is what we call a “mystery shop” with a couple of your forwarders. Imagine you’re one of your key shippers today, create a new identity with an imaginary shipment (similar to what you carry today), and reach out to a couple of large forwarders for detailed quotes. Pay attention to how much they quote you – and pay even more attention to what value-added services they include in their quote, or how much they’ll charge you for each service as an add-on.

Finally, here are some key points to keep in mind when developing your revenue growth strategy:

- Don’t try to do everything at once! It’s better to implement one new feature at a time and deliver it with consistently high quality.

- Don’t overinvest in complicated data systems that your company isn’t ready to use

- Bring your sales force on the journey; make sure they’re on board and understand why you’re expanding your value proposition

And remember, 1% isn’t the end of the journey – it’s just the beginning! And you can always “rinse and repeat” as you look for new service features to add and more sophisticated ways to price your available capacity

Of course, cost discipline still matters, but growing your revenue is an easier, more powerful, and more sustainable way to increase your profits.